Select your country

Acting together

Meeting tomorrow’s challenges together with trust, transparency and integrity

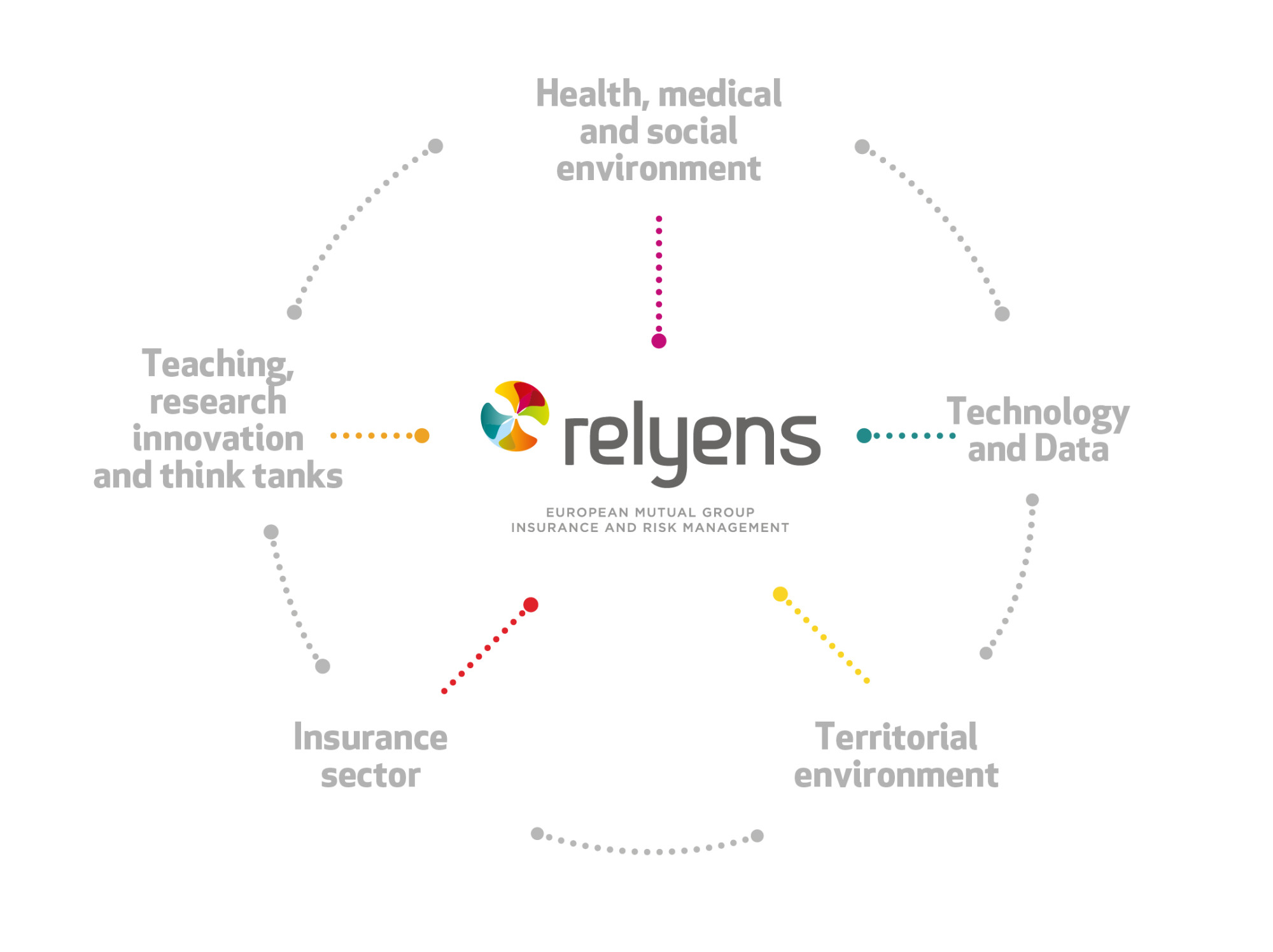

Relyens is positioned at the crossroads of the worlds of Health, Territorial Action, New Technologies and Insurance. This strategic position allows us to be at the heart of the reflections of our ecosystem and to favour dialogue, collaboration and alliances between its actors.

Today, we want to create new synergies around our common challenges, in particular the medical, HR and technological risks faced by our clients and members.

Because we are convinced that together we will go further, we are working to make our Group an even more open company in its environment, linking the interests and skills of our clients, partners, employees and co-operators for greater collective success.

A powerful network of committed partners

Federations, associations, learned societies, insurance players, innovative companies, think tanks, trade unions, schools, decision-makers. Our multiple regional, national and european partners all contribute in their own way to work towards a common goal: anticipating changes in the health and local authority ecosystems and helping those who work in them to continuously improve their activities.

Our long-term relationships are based on a shared requirement of trust, transparency and integrity. Based on knowledge sharing and co-construction, they create value and make our joint action meaningful.

We work together for the long term, shaping the transformation of the care system and local services in Europe, for the benefit of its citizens.

Insurance sector

Building on our mutualist dna and our experience as an insurer since 1927, we develop and maintain close relationships with professional organisations in the insurance sector in france and europe. Today, we are keen to nurture and develop these local ties by sharing our expertise and participating in a virtuous circle of dialogue and reflection on the transformation of the insurance industry.

We all share the same aim of exploring new avenues, such as reducing vulnerabilities, sustainable social protection and risk management, to meet the growing needs of policyholders.

Health and medical social environment

Our active involvement alongside the main federations and associations representing healthcare and medical social institutions and their stakeholders places us at the heart of the transformation of health systems in Europe, where we can best support our customers and members. Our shared objective is to facilitate better health care and health management for all, in a high-quality safe environment.

Whether national colleges, learned societies, accreditation bodies or endowment funds, we work closely with key bodies representing health professionals to support them in managing the risks associated with their activities. Our risk management support focuses on 3 areas: initial and continuous training, optimisation of the human factor, and the provision and promotion of innovative tech-driven solutions.

Cultivating and deepening our local relationships with healthcare professionals serves our aim of remaining as close as possible to the risks at stake so as to limit their impact and facilitate safe patient care.

Local authority environment

Alongside elected representatives, regional decision-makers and their associations, federations and schools in the sector, within our ecosystem we are involved in promoting a new vision of occupational health and risk management for local stakeholders.

Working in contact with institutional partners, parliamentarians and decision-makers, we provide an informed opinion and a singular vision of the changes underway in the local authority ecosystem.

Our group is a member and sponsor of the Cercle des Acteurs Territoriaux. As part of this think tank, we are working on better understanding and anticipating the impacts of changes in our society and legislative developments on public action. Our aim is to provide, compare and develop new organisational and managerial solutions for local authorities focusing on responsibility, trust, ongoing experimentation and the reappropriation of the value of work.

Teaching, research, innovation, think tank

Along with our partners, we are driven by a common goal: to share and pass on our expertise and best practices so as to benefit as many people as possible. Our aim is to provide a renewed and shared vision of risk management and to connect the healthcare and local authorities worlds with those of digital and technological innovation.

To this end, we are involved in training future directors and managers who will build the health and local authority worlds of tomorrow. Together with our partners, we produce valuable content and scientific publications and support the research work of young people and professional associations. We jointly facilitate and actively contribute to debates on issues relating to the quality and safety of care and local action in europe.

.

Technology and data

We build data- and ai-driven solutions into our risk management approach. These solutions enable us to tackle risk factors upstream and in real time in order to provide predictive insights and prevent risks from materialising.

We can digitise, structure and process all our customers’ data so as to mitigate their risks. To this end, we work with various technology partners specialising in risk prevention and risk management. To ensure the quality and long-term performance of these techn-driven solutions, relyens acquires stakes in the companies it partners with.

A collective united around the same mission

To act and innovate,

alongside those who work for the common good,

to build a world of trust.